Economic Importance And Financial Impact Of Healthcare

In recent years, the pharmaceutical industry has witnessed increased political interest and attention due to the increased recognition of the economic importance and financial impact of healthcare as a component of national budgets. Biologic drugs (biologics) have attracted the attention of politicians since biologics have moved out of the niche pharmaceutical arena to contribute 17% of global pharmaceutical sales, representing revenues of more than $120bn in 2009.

THE BIOLOGICS MARKET

The market for biologics is growing at twice the rate of pharmaceutical drugs, placing significant cost pressures on government, employers, insurers, and patients. Government and insurers are using several strategies to contain costs but must ensure that the financial burden placed on patients does not restrict access to the health care system. Establishing a regulatory pathway for ‘follow-on’ biologics (biosimilars) was therefore felt to be necessary by many stake holders to encourage competition and reduce prices.

Many pharmacutical companies, both large and small, are expecting their bottom line growth to be driven by biosimilars and are channeling their R&D budgets to compete in what – according to many – is going to be one of the hottest areas in a radically changing global pharmaceutical market.

HISTORY

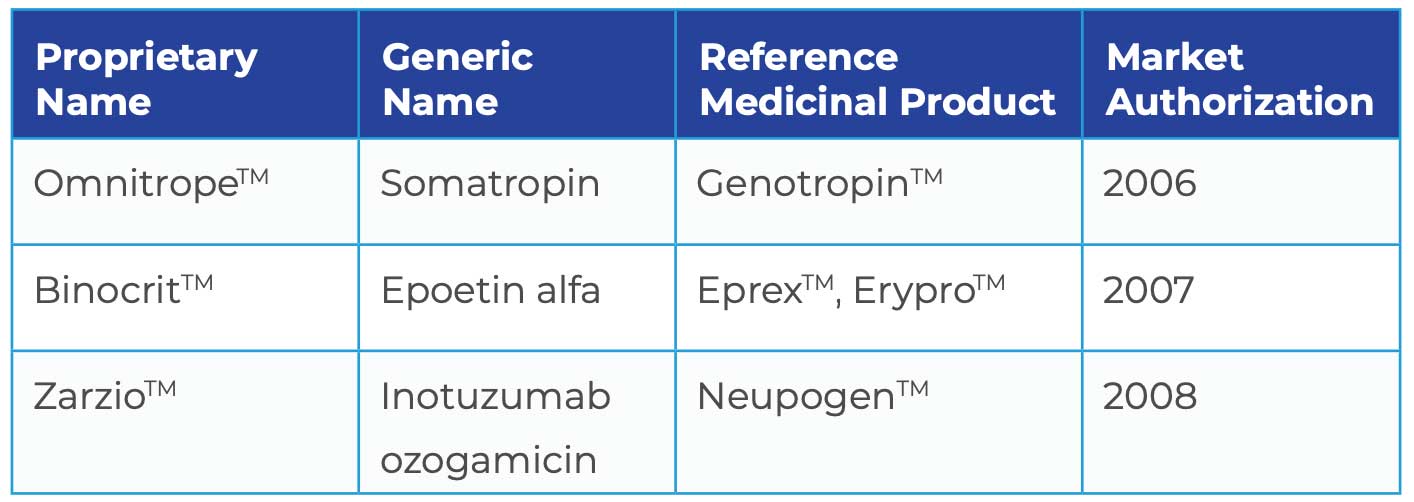

Novartis’ Sandoz unit pioneered the global biosimilar market with the development of a follow-on version of GenotropinTM which is currently marketed in the EU, US, Australia and Japan. By now, Sandoz has marketed three biosimilars in Europe indicating that the EU has sprinted ahead of the US in its approval of biosimilars:

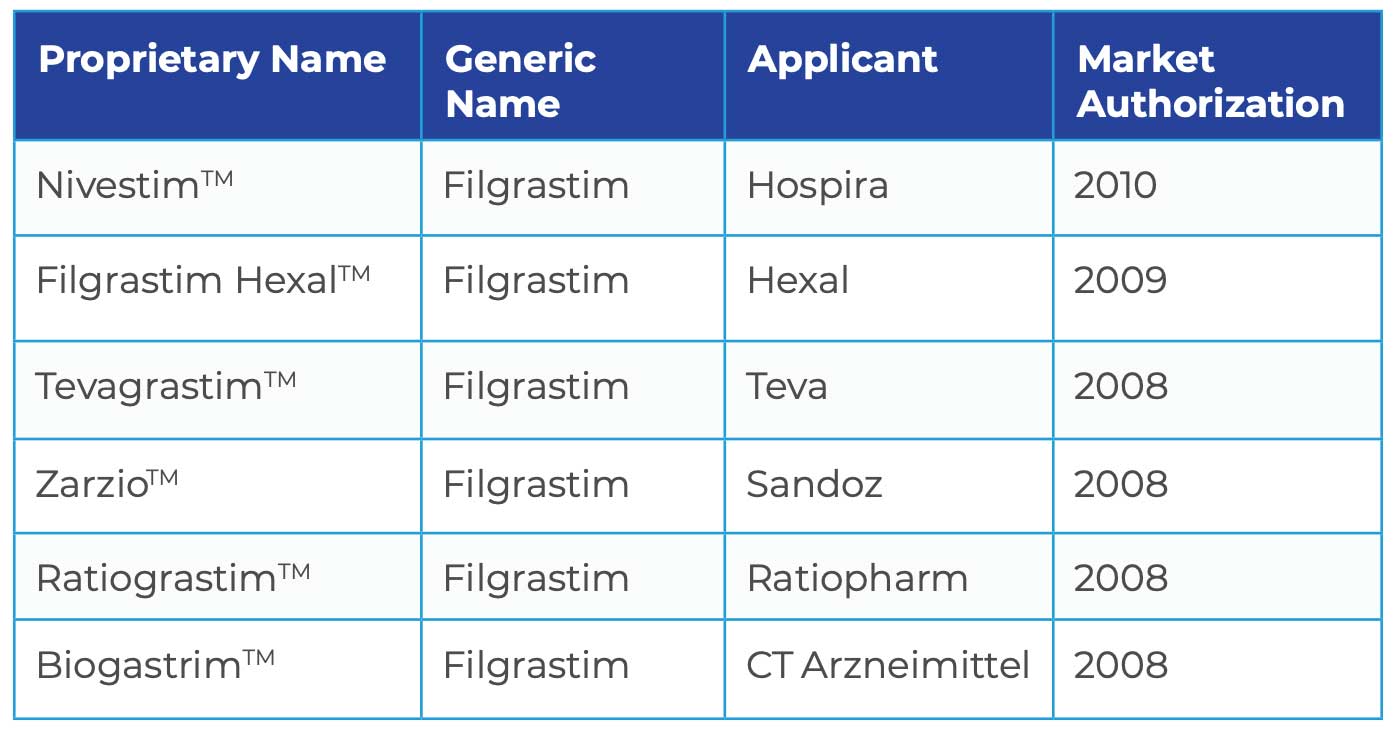

To appreciate the dynamics of the biosimilar market in Europe, there are currently six approved biosimilars to Amgen’s Neupogen™.

Without an abbreviated pathway for the approval of ‘generic’ versions of biologics in the US, the first generation of existing versions of similar biologics such as erythropoietin (ProcritTM and EpogenTM), botulinum toxin (BotoxTM, DysportTM, and MyoblocTM) and filgrastim (NeutrovalTM) were approved under a full Biosimilar License Agreement (BLA) each of which is not deemed interchangeable with its reference medicinal product. With the passage of the Biologics Price Competition and Innovation Act (‘the Biosimilar Act’) in 2009, an abbreviated pathway has also been created in the US for what is intended to be a streamlined development and FDA approval pathway for competing versions of already-marketed biologic drug products. Approval as a ‘biosimilar’ under the Biosimilar Act should save sponsors time and money in the development and approval process and must provide overall cost savings to patients and the health care system.

Although the new Biosimilar Act has been subject to criticism for its complexity with many important details left undefined or open-ended, it seems to have spurred many pharmaceutical giants, like Merck, Pfizer, Amgen, and Biogen Idec to jump on the biosimilars bandwagon, many placing a focus on emerging markets in Asia and South America. Companies other than big pharma are also showing an interest in biosimilars. Many generic companies such as Teva, Hospira, Ratiopharm, Actavis and even non-pharma e.g. electronics giant, Samsung, are entering this new pharmaceutical market. Meanwhile, Novartis’ Sandoz unit has already proved itself to be a major player in the biosimilars market, being the only manufacturer to have three biosimilars on the market.

THE INTRICACIES OF BIOSIMILAR DRUG DEVELOPMENT

Although biosimilar development is considered by many to be a low risk drug development activity, safety is a priority for the development of all medicines and there is no doubt that biologics raise safety considerations above and beyond those of chemical drugs. This is because biologics are structurally more complex molecules than chemical drugs, and even slight changes in their manufacturing process can cause hard to detect changes in the composition of the final product. These changes can in turn affect the safety and effectiveness of the product in patients. So, when a follow-on manufacturer establishes a new manufacturing process, beginning with new starting materials, it will produce a product that is different from and not therapeutically equivalent to that of the innovator. Because of the complexity of biologics, the only way to establish whether there are differences that affect the safety and effectiveness of the follow-on product is to conduct nonclinical and clinical trials.

It is interesting to note from the Committee for Medicinal Products for Human Use (CHMP) assessment reports relating to the applications for the six filgrastim biosimilar medicinal products that the body of clinical evidence supporting similarity between those six biosimilars and NeupogenTM is quite different. Issues were raised in the CHMP assessment reports on the reliability of biosimilar plasma concentration analyses causing PK results to be inaccurate and thus requiring repeat validation of the ELISA assays and reanalysis of the PK data.

On many occasions, the CHMP also stated that development and validation of antibody assays were poorly described, and the bioanalytical testing strategy did not follow regulatory guidelines. As a result, follow-up measures for determining the possible development of immunogenicity were often asked for as there was not enough data to demonstrate adequate sensitivity and detection of biosimilar antibodies. Consequently, additional long-term safety and immunogenicity data had to be collected in the post- marketing phase leading to unnecessary use of time and resources.

QPS IS COMMITTED TO WORKING WITH YOU

QPS has extensive experience with biosimilar development, and we truly understand the scientific complexities, in particular around ligand binding assays to allow for robust PK and antibody assessments and the pivotal bioanalytical test strategies for the determination of the possible development of immunogenicity. We are committed to working with you to assist you in advancing your biosimilar portfolio in this rapidly developing market segment for the benefit of patients worldwide.

TIMELY DELIVERY

Partnering with QPS will position you for success, allowing timely delivery of your biosimilar products to the marketplace.

REFERENCES

1. Fresh from the Biologic Pipeline – 2009 Nature Biotechnology 2010; 28: 307 – 310

2. Hearing Shines Spotlight on Biosimilar Controversies Nature Reviews Drug Discovery 2010; 9: 905 – 906

3. Balancing Innovation, Access, and Profits – Market Exclusivity for Biologics N Engl J Med 2009; 361: 917 – 1919